Artificial Intelligence (AI) is transforming financial decision-making. From data analysis to risk management, businesses are embracing AI in finance but over-reliance introduces new risks. It can analyze vast amounts of data, identify patterns, and make recommendations in seconds. The fact that AI is strong but not flawless must be faced by businesses as more of them use it.

Over-reliance on AI for financial decisions can introduce a new class of risks, technical, ethical, and operational. Understanding these risks is the first step; the second is learning how to mitigate them.

1. Data Bias Becomes Decision Bias in AI in Finance

AI learns from the data it is fed. If that data is outdated, incomplete, or skewed, the system will simply repeat and amplify those flaws. In finance, this could mean rejecting worthy credit applicants, prioritizing the wrong investments, or misunderstanding customer behavior. This shows why businesses must approach AI in financial decision-making with caution

In Fidelity Bank’s AI case study, prediction accuracy dropped significantly when the training data lacked diversity or was not refreshed frequently.

2. Why Context Gets Lost in AI in Finance Automation

AI is excellent at detecting patterns, but it does not understand nuance. Human decisions often consider legal, cultural, or ethical factors that algorithms can not interpret. An AI system may suggest a profitable move that ignores regulatory boundaries or brand risks.

3.Cybersecurity & Privacy Risks of AI in Finance

AI systems consume large volumes of data. This creates vulnerabilities, especially when systems are poorly secured or the organization has not fully aligned with data protection regulations like Nigeria’s Data Protection Act (NDPA). A single breach can trigger regulatory sanctions and loss of client trust. In finance, weak cybersecurity can derail the promise of AI in decision-making

4. Limited Transparency in Decision Logic

Some AI models function like black boxes, offering answers without clear reasoning. In finance, where transparency and accountability are key, this is dangerous. Without an explainable system, it is difficult to justify financial decisions to stakeholders, auditors, or regulators.

5. Complacency from Reduced Oversight

When teams start to rely blindly on AI-generated insights, they stop thinking critically. Over time, this erodes human judgment, weakens governance structures, and increases the risk of unnoticed anomalies.

6. Ethical and Legal Grey Areas

AI does not have ethics; it just optimizes outcomes. This can lead to decisions that are legally compliant on paper but harmful to clients, staff, or society. In the wrong hands, AI can easily become a tool for discrimination or manipulation.

7. Talent and Infrastructure Gaps

Many organizations specially SMEs and NGOs; lack the skills or infrastructure needed to safely implement AI. Without the right people or systems in place, even the most sophisticated tools can cause harm instead of improvement.

Minimizing the Risks of AI in Finance

AI does not have to be risky. The key is managing it with structure, caution, and human oversight. Here is how:

- Start with Clean, Inclusive Data: Audit and vet training datasets before feeding them into your systems.

- Use Explainable AI Platforms: Prioritize tools that show how decisions are made.

- Establish Human-AI Review Loops: Every important AI-driven recommendation should be reviewed by a qualified person.

- Implement AI Governance: Build internal policies for ongoing audits, model checks, and compliance reviews.

- Train Your Team: Ensure decision-makers understand both the potential and the limits of AI.

- Invest in Cybersecurity: Secure data storage and access are non-negotiable for AI systems.

- Document Everything: Keep records of how models were trained, who reviewed outputs, and what decisions were made.

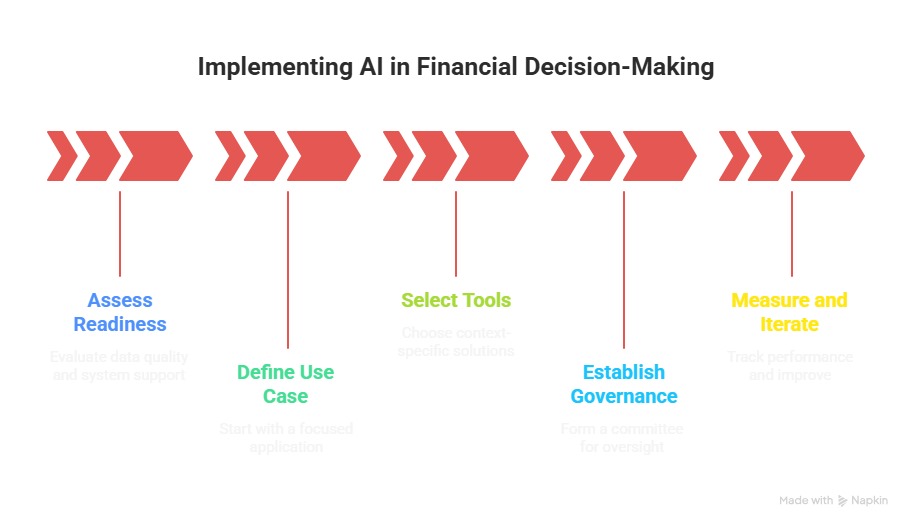

Implementing AI in Financial Decision-Making

Before investing in AI for finance, follow a structured approach:

1. Assess Your Readiness

Evaluate your internal data quality, infrastructure, and compliance maturity. Can your current systems support AI reliably?

2. Define the Use Case

Start with one application, forecasting cash flows, detecting fraud, scoring credit risk. A focused pilot helps reduce complexity.

3. Select Localized, Scalable Tools

Choose solutions designed for your context, Nigeria’s laws, your sector’s compliance needs, your team’s capacity.

4. Establish AI Governance

Appoint a cross-functional AI committee (finance, risk, IT) to monitor usage, interpret results, and enforce accountability.

5. Measure, Iterate, and Scale

Track performance. Was the AI decision better, faster, or cheaper? Use results to improve, then expand gradually.

Final Thoughts

AI in finance should sharpen decision-making, not remove responsibility. It is a tool, not a strategy. When used responsibly, it increases speed, accuracy, and foresight. But without structure and human oversight, it exposes institutions to new vulnerabilities.

At Wells Accounting & Tax Services, we help organizations adopt AI responsibly, grounded in governance, ethics, and clarity. The future of finance is intelligent. But it is also accountable, and that’s where we come in.

No comment